Quick Facts

- Fact 1: MetaTrader 4 (MT4) Expert Advisors (EAs) are automated trading systems developed for the MT4 platform.

- Fact 2: EAs with low drawdown aim to minimize potential losses and maintain stable performance.

- Fact 3: Low drawdown EAs typically use strategies such as stop-loss orders, trailing stops, and position sizing.

- Fact 4: These EAs monitor market conditions and adapt trading decisions to minimize losses and maximize gains.

- Fact 5: Common strategies used in low drawdown EAs include trend following, mean reversion, and scalping.

- Fact 6: Low drawdown EAs can be backtested on historical data to evaluate performance and determine optimal parameters.

- Fact 7: Optimization techniques, such as walk-forward optimization and genetic algorithms, can be used to refine EA performance.

- Fact 8: Traders should continuously monitor and adjust their low drawdown EAs to ensure they remain effective in changing market conditions.

- Fact 9: Low drawdown EAs may not always produce the highest returns, as risk management takes priority over profit maximization.

- Fact 10: Traders should be cautious when using EAs with low drawdown and thoroughly evaluate their performance before deploying them in live markets.

Low Drawdown MT4 EA: A Key to Successful Forex Trading

Forex trading can be a lucrative venture, but it also comes with significant risks. One of the most significant risks is drawdown, which refers to the peak-to-trough decline in the value of a trading account. A high drawdown can be catastrophic, leading to significant losses and even account wipeouts. However, with the right tools and strategies, traders can minimize drawdown and maximize their returns. In this article, we’ll explore the concept of low drawdown MT4 EA (Expert Advisor) and how it can help traders achieve their goals.

What is an MT4 EA?

An MT4 EA is a software program that automates trading decisions in the MetaTrader 4 (MT4) platform. MT4 is one of the most popular trading platforms among forex traders, and EAs are a crucial part of its functionality. An EA can be programmed to follow specific trading strategies, risk management rules, and market conditions, making it an essential tool for traders who want to automate their trading.

What is a Low Drawdown MT4 EA?

A low drawdown MT4 EA is an Expert Advisor that is designed to minimize drawdown while maximizing returns. This type of EA uses various strategies, such as hedging, diversification, and risk management, to reduce the risk of significant losses. A low drawdown EA is essential for traders who want to preserve their capital and achieve consistent returns over time.

Benefits of Using a Low Drawdown MT4 EA

- Reduced risk: A low drawdown EA minimizes the risk of significant losses, protecting your trading capital.

- Consistent returns: By reducing drawdown, a low drawdown EA can help you achieve consistent returns over time.

- Improved performance: A low drawdown EA can improve your overall trading performance, leading to higher profit margins.

- Increased confidence: By using a low drawdown EA, you can trade with confidence, knowing that your capital is protected.

How to Choose a Low Drawdown MT4 EA

- Strategy: Look for an EA that uses a proven strategy, such as trend following or mean reversion.

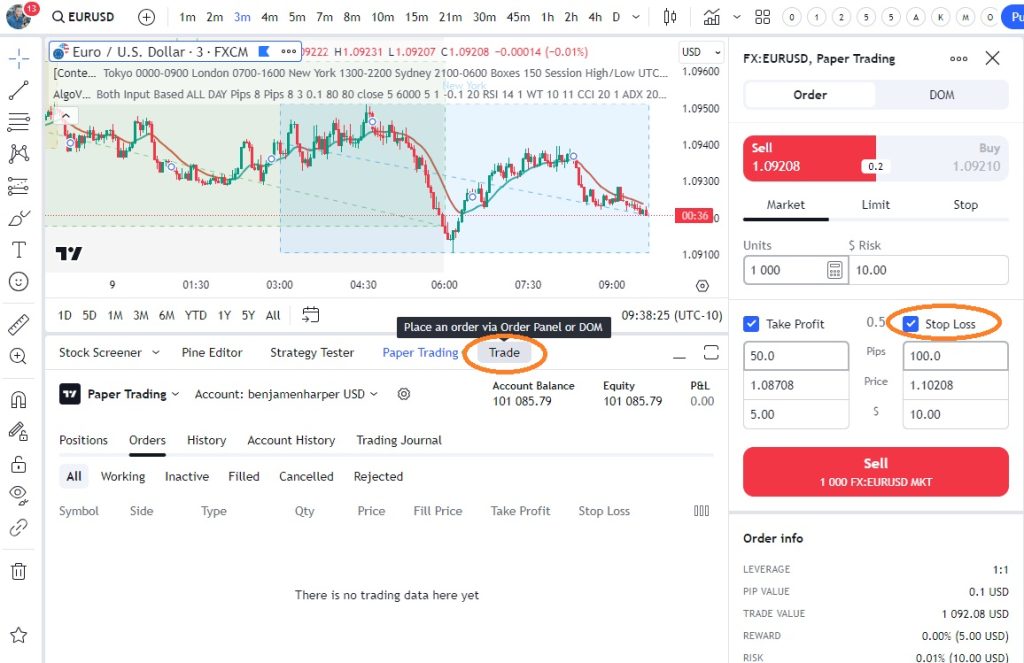

- Risk management: Ensure that the EA has robust risk management rules, such as stop-loss and take-profit orders.

- Performance: Evaluate the EA’s historical performance, looking for consistent returns and low drawdown.

- Reviews: Read reviews from other traders to get a sense of the EA’s reliability and effectiveness.

Top Low Drawdown MT4 EAs

- EA Nova: This EA uses a combination of technical and fundamental analysis to identify trading opportunities.

- EA Zulu: This EA uses a trend-following strategy to identify and profit from market trends.

- EA Apollo: This EA uses a mean reversion strategy to identify and profit from market inefficiencies.

Common FAQs

- Q: What is the best low drawdown MT4 EA?

A: The best low drawdown MT4 EA is one that uses a proven strategy, robust risk management rules, and has consistent performance.

- Q: How do I install a low drawdown MT4 EA?

A: To install a low drawdown MT4 EA, simply download the EA file, copy it to the MT4 platform, and attach it to a chart.

- Q: Can I use a low drawdown MT4 EA on a demo account?

A: Yes, you can use a low drawdown MT4 EA on a demo account to test its performance and evaluate its effectiveness.

Additional Tips and Recommendations

- Test a low drawdown MT4 EA on a demo account before using it on a live account.

- Monitor the EA’s performance regularly and adjust its settings as needed.

- Use a low drawdown MT4 EA in conjunction with other risk management tools, such as stop-loss and take-profit orders.

- Continuously educate yourself on trading strategies and market analysis to improve your overall trading performance.

MT4 EA with Low Drawdown: Frequently Asked Questions

Q: What is an MT4 EA?

An MT4 EA (Expert Advisor) is a software program designed to automate trading on the MetaTrader 4 (MT4) platform. It uses algorithms to analyze market data and execute trades based on pre-defined rules.

Q: What is drawdown?

Drawdown is the maximum peak-to-trough decline in the value of a trading account. It represents the worst-case scenario for a trader, indicating the maximum potential loss.

Q: Why is low drawdown important?

Low drawdown is crucial for traders as it minimizes potential losses and maximizes returns. A lower drawdown means less risk and more stability in trading, which is essential for long-term success.

Q: What features should I look for in an MT4 EA with low drawdown?

When evaluating an MT4 EA with low drawdown, look for the following features:

- Robust risk management: The EA should have a solid risk management system to limit exposure and minimize losses.

- Conservative trading strategy: The EA should employ a conservative trading strategy that avoids large positions and high-risk trades.

- Proven track record: Look for an EA with a proven track record of low drawdown over an extended period.

- Regular updates and maintenance: Ensure the EA is regularly updated and maintained to adapt to changing market conditions.