Table of Contents

Quick Facts

- 1. A stop loss in Forex orders should be placed below the recent lows.

- 2. Also, the stop loss should be above the recent highs.

- 3. Furthermore, your stop loss should be centered around the current market price.

- 4. You can set a 2-5% stop loss immediately above a recent high or below a recent low.

- 5. or 50-100 pips.

- 6. Always put a protective trailing stop loss.

- 7. Moreover, increasing the stop loss distance by 10-20 pips as the price moves in your favor.

- 8. It’s also crucial to set multiple stop loss levels.

- 9. Position sizing can be used alongside your stop loss order to limit potential losses.

- 10. Additionally, it’s recommended to combine multiple risk management strategies, such as stop-losses, position sizing, and scale-up triggers.

How to Set Forex Stop Loss at FPG: A Practical Guide

What is Fair Price Gap (FPG)?

Fair Price Gap is a technical analysis approach that identifies gaps in price action where the market has deviated from its fair value. These gaps often serve as levels of support and resistance, which can be useful for setting stop losses.

Why Set a Stop Loss at FPG?

By setting a stop loss at FPG, you’re limiting your potential loss to a specific level, rather than risking a larger portion of your capital. You can set a more realistic profit target, improving your risk-reward ratio and increasing your chances of success. Knowing that your stop loss is set at a logical level can give you the confidence to hold onto a trade, even when the market gets volatile.

How to Set a Stop Loss at FPG: A Step-by-Step Guide

Step 1: Identify the Gap

The first step is to identify a gap in price action. You can use a charting platform like MetaTrader or TradingView to spot gaps. Look for areas where the price has deviated from its fair value, such as after a news event or a sudden change in market sentiment.

Step 2: Determine the Gap Size

Once you’ve identified a gap, determine its size. This will help you set a more precise stop loss level. You can use a measurement tool like a Fibonacci retracement or a simple price action analysis to estimate the gap size.

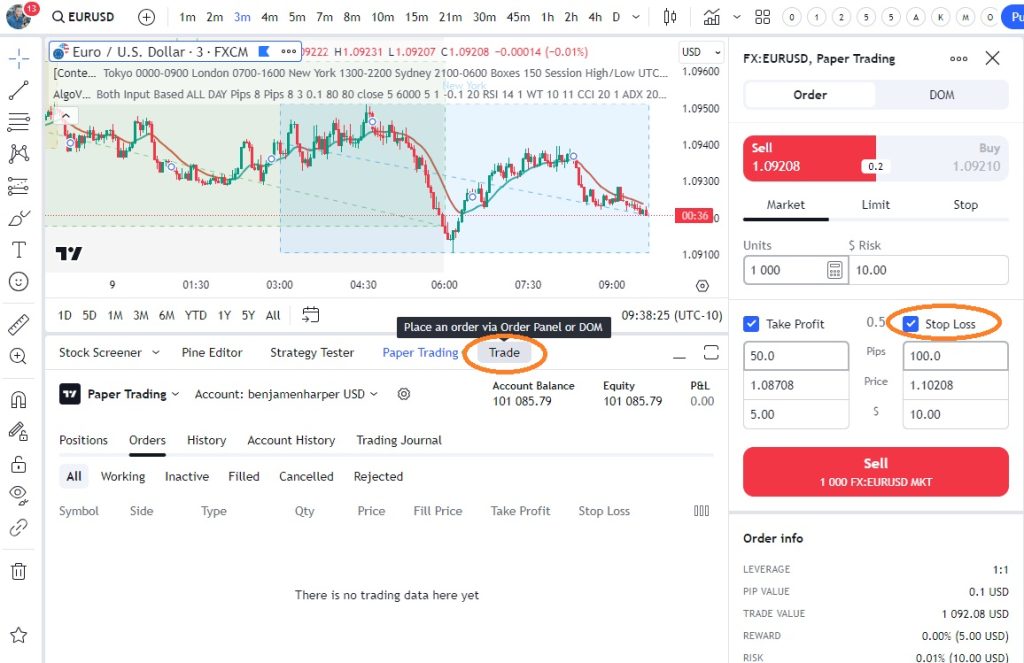

Step 3: Set the Stop Loss

Using the gap size, set your stop loss a few pips below the gap level (for a long trade) or above the gap level (for a short trade). This ensures that your stop loss is not too close to the entry price, but still provides a reasonable level of protection.

Step 4: Monitor and Adjust

As the trade unfolds, monitor the price action and adjust your stop loss accordingly. If the trade moves in your favor, you can trail your stop loss to lock in profits. If the trade moves against you, consider adjusting your stop loss to a more conservative level.

| Trade Scenario | Gap Size | Stop Loss Level |

|---|---|---|

| Long EUR/USD after a news event | 30 pips | 1.1000 (20 pips below gap level) |

| Short GBP/USD after a candlestick reversal | 50 pips | 1.2500 (25 pips above gap level) |

| Long USD/JPY during a trend continuation | 20 pips | 110.50 (15 pips below gap level) |

Tips and Tricks

Here are a few additional tips to keep in mind when setting a stop loss at FPG:

- Use a buffer: Consider adding a small buffer to your stop loss level to account for market volatility.

- Be flexible: Don’t be afraid to adjust your stop loss level as the trade unfolds.

- Combine with other strategies: FPG is just one strategy – consider combining it with other technical analysis tools, like support and resistance levels or moving averages.

Frequently Asked Questions:

Q: What is a stop loss in Forex trading?

A stop loss is an order that automatically closes a trade when it reaches a certain price level, limiting potential losses. It’s an essential risk management tool in Forex trading.

Q: Why is it important to set a stop loss at FPG?

Setting a stop loss at FPG helps you manage risk and prevent significant losses in your trading account. It ensures that you can limit your potential losses and protect your capital.

Q: How do I set a stop loss at FPG?

To set a stop loss at FPG, follow these steps:

- Log in to your FPG trading account.

- Select the trade you want to set a stop loss for.

- Click on the “Edit” button next to the trade.

- In the “Edit Trade” window, click on the “Stop Loss” tab.

- Enter the price level at which you want to set the stop loss.

- Choose the type of stop loss: fixed or trailing.

- Click “Save” to apply the changes.

Q: What is the difference between a fixed stop loss and a trailing stop loss?

A fixed stop loss is set at a specific price level and remains at that level until the trade is closed or the stop loss is updated. A trailing stop loss, on the other hand, adjusts automatically to a certain distance from the current market price, allowing your profit to grow while limiting potential losses.

Q: Can I set multiple stop losses for a single trade?

No, you can only set one stop loss per trade at FPG. If you want to set multiple stop losses, you’ll need to create separate trades with different stop loss levels.

Q: Can I edit or cancel a stop loss order?

Q: Will I be notified when my stop loss is triggered?

If you have any further questions or concerns about setting stop losses at FPG, please don’t hesitate to contact our support team.