Starting to use AlgoV1 for back testing strategies can really amp up your trading journey. This tool makes testing different strategies a breeze, offering valuable insights that could lead to potential growth in your trading endeavors.

In this blog, we’ll delve into the features of AlgoV1 and how you can leverage them to optimize your trading approach.

AlgoV1

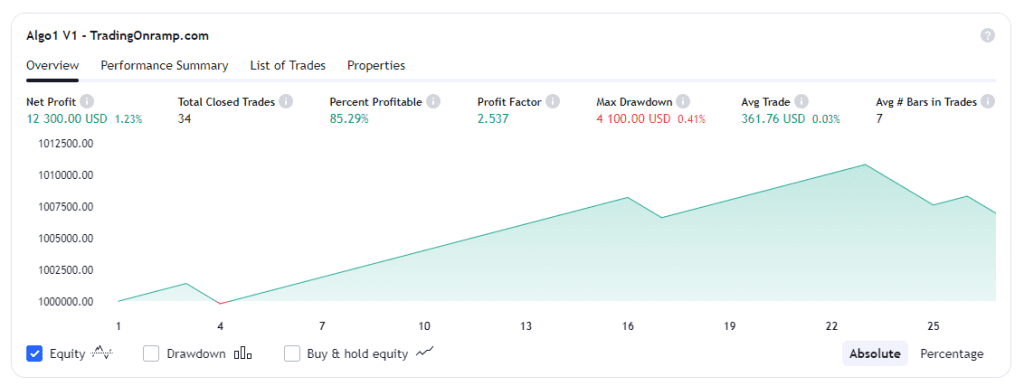

AlgoV1, our latest indicator, offers a user-friendly platform for conducting quick and efficient back testing. Whether you’re a seasoned trader or a novice, this tool can help you analyze different trading scenarios with ease.

Using our latest indicator, AlgoV1 will make it super easy for you to perform a range of back testing scenarios quickly and easily.

Perhaps you have been wondering what time of day is the best to trade, or how many trades you should take in any given day? What happens to your win rate if you take more trades, or less trades?

AlgoV1 has a number of filters and options that will allow you to test various scenarios and for you to see the testing results for your self.

AlgoV1 Back Testing Strategies – Filters and Options

Here’s a list of the latest back testing filters and options for you to experiment with and what they can help you determine:

- Time Filter – The AlgoV1 time filter allows you to choose different time periods and market sessions to trade. This allows you to compare for example, your results during the London session versus the New York trading session.

- Trade Count Filter – The trade count filter allows you to adjust how many trades the strategy performs during the selected time period. With this, you can resolve questions about the relationship between trade frequency and win rate. Explore to your hearts content and see the results for yourself in the strategy tester.

- Buy / Sell Priority Filter – Wondering what happens if you focus only on Buy opportunities or Sell opportunities individually? Or both? Now you can choose which trades to take.

- Take Profit / Stop Loss Filter – Modify your take profit and stop loss and test various strategies. You can try a tight or loose style and see how it impacts the results. You can test 2-1 risk reward and 1-1 risk reward strategies by modifying the TP / SL values.

Reset and Default Settings

If you wish to start afresh, AlgoV1 allows you to reset all variables back to default settings by selecting “Default” and “Reset Settings.”

Using the AlgoV1 back testing capabilities has the potential of upleveling your trading and allows you to explore a wide variety of potential strategies in a short amount of time.

If you love trading, learn to love back testing and feel free to share with us any interesting results. We have also spent hundreds of hours back testing with this tool and our results are reflected in the default settings which currently yield results slightly above 80% win rate. If you find more profitable settings, or better results on other currency pairs, please do let us know. We are always searching for better performance results.

Elevate Your Trading with AlgoV1

Utilizing AlgoV1’s back testing capabilities has the potential to uplevel your trading strategies swiftly. Explore a variety of scenarios in a short amount of time, gaining valuable insights into what works best for your trading style.

Share Your Discoveries

We encourage you to share any interesting results from your back testing endeavors. While our default settings currently yield results slightly above an 80% win rate, discovering more profitable settings or achieving better results on different currency pairs is always welcome. Your insights contribute to our ongoing quest for improved performance.

Happy Trading with AlgoV1!

Get ready to unlock the advantages of back testing using AlgoV1! I wish your time with it is full of successful moments and that you discover some clever ways to make your trading journey more profitable.

If you uncover noteworthy settings or results, don’t hesitate to share them with us. We are dedicated to continual improvement and value your contributions to the trading community. Happy trading!

Frequently Asked Questions (FAQs)

Q1: What is AlgoV1, and how does it enhance my trading experience?

A: AlgoV1 is our latest indicator designed for back testing scenarios, providing a simplified and efficient platform for traders. It empowers users to explore various strategies and optimize their trading approach.

Q2: How can AlgoV1 help me determine the best time of day to trade?

A: AlgoV1 introduces a Time Filter feature that allows you to choose different time periods and market sessions. This enables you to compare trading results during specific sessions, such as the London session versus the New York trading session.

Q3: Can I adjust the number of trades the strategy performs, and what insights can I gain from this?

A: Yes, AlgoV1 includes a Trade Count Filter, enabling you to customize the trade frequency during a selected time period. This feature helps you explore the relationship between trade frequency and win rate.

Q4: How does the Buy/Sell Priority Filter work, and what scenarios can I explore with it?

A: The Buy/Sell Priority Filter allows you to focus on Buy opportunities, Sell opportunities, or both. This feature provides flexibility in choosing which trades to take, allowing you to tailor your trading strategy.

Q5: Can I modify take profit and stop loss values to test different strategies?

A: Yes, AlgoV1 offers a Take Profit/Stop Loss Filter, allowing you to adjust these values and test various strategies. Experiment with tight or loose styles and explore the impact on your trading results. Additionally, you can test 2-1 risk-reward and 1-1 risk-reward strategies.