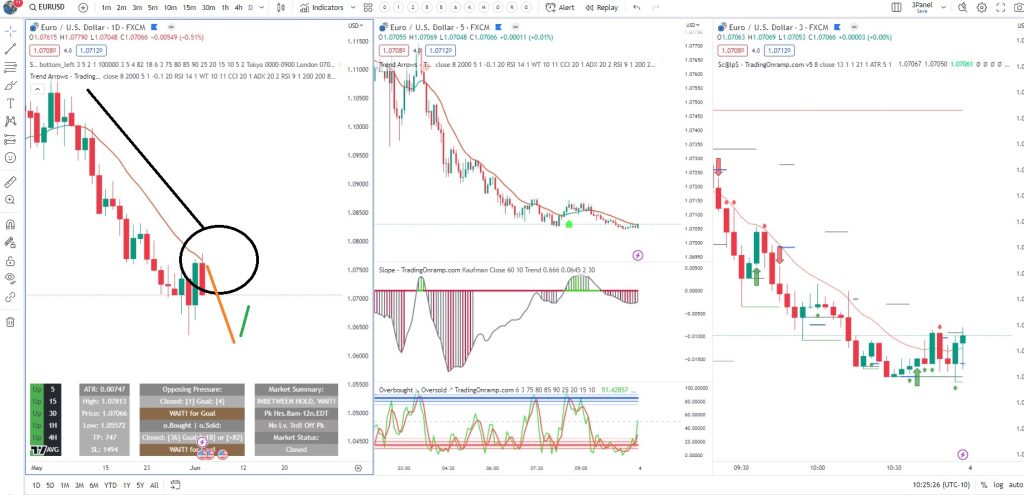

The EUR/USD currency pair has been experiencing a downward trend for the past 21 days and has been consistently trading below the established trendline during this period. Recently, there was a minor upward movement in the EUR/USD price, which resulted in a retest of the trendline. However, the price quickly reversed and moved back down.

Based on these facts, it is uncertain whether the EUR/USD will continue its downward trajectory or if it will eventually break above the trendline.

When it comes to the EUR/USD currency pair, there are mixed views on its market direction. Some people believe that a bullish correction might be on the horizon. They point out that there has been a recent breakout that could indicate potential upward movement. Additionally, they mention that the price has reached key levels, such as the yearly open, which could act as support and lead to a bounce. These individuals are looking at technical indicators and breakouts as positive signs that could present buying opportunities.

However, there are also those who maintain a bearish outlook for EUR/USD. They highlight the ongoing downtrend and observe that the price is encountering resistance levels, which could trigger further downward movement. They consider technical analysis, such as downward channels and potential extensions, as indications of a bearish sentiment. Furthermore, they mention that the Euro’s weakness could contribute to the downward pressure on EUR/USD.

Given these differing perspectives, it’s important to approach trading with caution and conduct thorough analysis. Staying informed about the latest market developments, using risk management strategies, and considering a combination of technical and fundamental analysis can help make more informed trading decisions. By keeping a close eye on the market dynamics, we can adapt our strategies and navigate the EUR/USD landscape more effectively.