How I Achieved Full Automation of My Trading Strategy in MetaTrader 4

In today’s fast-paced financial markets, automation has become a key element for traders aiming to optimize their strategies and save valuable time. I recently took the plunge into automating my trading strategy using MetaTrader 4, a popular and powerful trading platform. In this blog post, I’ll share my journey and the steps I took to achieve full automation, allowing me to make data-driven trading decisions and improve my overall trading experience.

- Understanding MetaTrader 4 (MT4): MetaTrader 4 is a widely-used platform that provides the tools and features necessary for both manual and automated trading. It supports automated trading through Expert Advisors (EAs) – custom scripts that can execute trades on your behalf based on predefined criteria.

- Defining My Trading Strategy: Before diving into automation, I meticulously defined my trading strategy. This involved setting clear entry and exit criteria, risk management rules, and incorporating technical indicators to guide my trading decisions. A well-defined strategy is crucial for effective automation.

- Learning MQL4 Programming: MQL4 is the programming language used in MetaTrader 4 for creating Expert Advisors. I dedicated time to learn MQL4, which enabled me to convert my trading strategy into a functional EA. Learning the basics of MQL4 is essential for anyone looking to automate their trading on MT4.

- Developing the Expert Advisor (EA): Using my knowledge of MQL4, I began developing my custom Expert Advisor based on my trading strategy. This involved coding the logic for entry and exit points, incorporating risk management rules, and optimizing the EA’s performance.

- Backtesting and Optimization: After developing the EA, I conducted extensive backtesting using historical data to ensure its effectiveness and reliability. I made necessary adjustments to optimize its performance and align it with my trading objectives.

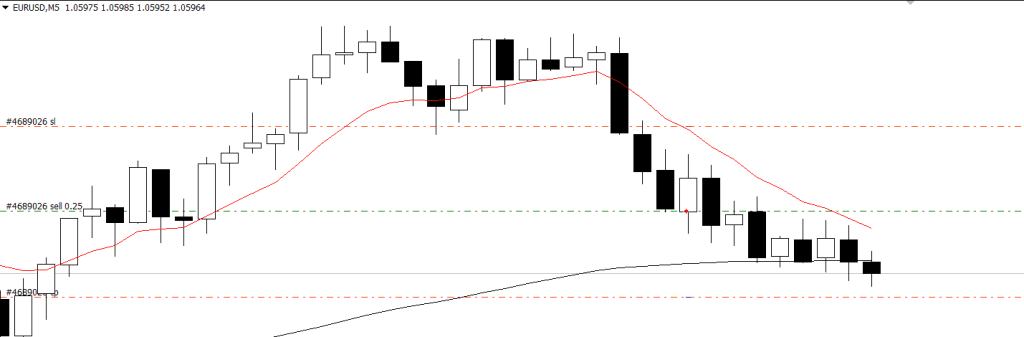

- Forward Testing and Refinement: To further validate the EA’s performance and behavior in real-time conditions, I conducted forward testing on a demo account. This allowed me to identify any potential issues and refine the EA accordingly.

- Live Deployment and Monitoring: With a thoroughly tested and refined EA, I deployed it on a live trading account with caution, starting with a small investment. I closely monitored its performance, making adjustments as needed to enhance its efficiency and effectiveness.

- Continuous Improvement: Automation doesn’t end at deployment. I consistently monitor and analyze the EA’s performance, making iterative improvements based on market conditions and any feedback from the trading community.

Automating my trading strategy in MetaTrader 4 has been a transformative journey, allowing me to save time, eliminate emotional trading, and enhance the precision of my trades. If you’re considering automating your trading strategy, I encourage you to follow these steps and invest time in learning MQL4 to make the most of this powerful platform. Happy trading!

If you are interested in using our fully automated trading strategy for MetaTrader 4, please email me at ben@tradingonramp.com or signup online to start today.