Table of Contents

- Quick Facts

- Stop Loss vs Trailing Stop Forex Strategies

- The Basics: Stop Loss and Trailing Stop

- My Experience with Stop Loss

- The Benefits of Trailing Stop

- Comparison of Stop Loss and Trailing Stop

- Real-Life Examples: When to Use Each Strategy

- Frequently Asked Questions

Quick Facts

- A stop loss is a loss-limiting mechanism that automatically closes a losing position based on a set price, protecting potential further losses.

- A trailing stop, on the other hand, involves adjusting the stop-loss price as the trade moves in the trader’s favor to lock in profits and limit potential losses.

- Trailing stops are more commonly used in trending markets, where the price moves consistently in a specific direction.

- Stop loss orders are typically used in range-bound or sideways markets where the price is fluctuating within a specific range.

- Trailing stops are less effective in range-bound markets, as they would result in unnecessary price swings.

- The key to using trailing stops effectively is to avoid over-trailing, where the stop-loss price moves too far away, causing unnecessary losses.

- Stop loss orders can be used with both manual and automated trading systems, while trailing stops are often used with automated systems that continuously monitor the trade.

- Trailing stops often require a leverage of at least 10:1, to minimize the impact of market volatility on the stop-loss price.

- A well-set stop-loss can help prevent significant losses, while a well-set trailing stop can help maximize gains.

- Ultimately, the choice between a stop loss and trailing stop depends on the trader’s market analysis, risk tolerance, and profit goals.

Stop Loss vs Trailing Stop Forex Strategies

As a seasoned forex trader, I’ve been in the trenches, experimenting with various strategies to minimize losses and maximize gains. Two popular techniques that often raise questions among traders are Stop Loss (SL) and Trailing Stop (TS). In this article, I’ll share my personal experience, comparing these two strategies and providing practical insights to help you make informed decisions.

The Basics: Stop Loss and Trailing Stop

Before we dive into the nitty-gritty, let’s quickly define these two strategies:

- Stop Loss (SL): A fixed price level at which a trade is automatically closed to limit potential losses. For example, if you set a SL at 1.2000, and the market price reaches that level, your trade will be closed.

- Trailing Stop (TS): A stop-loss order that adjusts itself to a certain distance from the current market price. For instance, if you set a TS of 20 pips, and the market moves in your favor, the TS will automatically adjust to 20 pips above the new price.

My Experience with Stop Loss

I remember a trade I made in EUR/USD back in 2020. I had entered a long position at 1.1000, with a SL set at 1.0900, expecting the price to rise. However, due to some unexpected economic news, the price plummeted to 1.0800, hitting my SL and closing my trade. At first, I was relieved to have limited my loss, but then I realized that I had missed out on a potential gain as the price eventually rebounded to 1.1200.

This experience taught me that SL can be a double-edged sword. While it protects your capital, it can also limit your potential gains.

The Benefits of Trailing Stop

Fast-forward to 2022, when I started experimenting with TS. I set a long position in USD/JPY at 110.00, with a TS of 20 pips. As the price rose to 110.50, my TS automatically adjusted to 110.30. This allowed me to lock in some profits while still giving the trade room to breathe.

The benefits of TS became apparent:

- Flexibility: TS adjusts to changing market conditions, giving your trade more room to move in your favor.

- Locking in profits: As the price moves in your favor, TS helps you secure some profits, reducing anxiety and emotional decision-making.

Comparison of Stop Loss and Trailing Stop

Here’s a summary of the key differences between SL and TS:

| Strategy | Fixed Price | Adjusts to Market Price | Benefits | Drawbacks |

|---|---|---|---|---|

| Stop Loss (SL) | Yes | No | Limits potential losses | Can limit potential gains |

| Trailing Stop (TS) | No | Yes | Locks in profits, flexibility | Can trail too far, leading to larger losses |

Real-Life Examples: When to Use Each Strategy

Here are some scenarios to help you decide when to use SL or TS:

- Turbulent markets: Use SL to limit potential losses in highly volatile markets.

- Range trading: Use TS to lock in profits in range-bound markets, where prices are oscillating between clear support and resistance levels.

- Breakout trades: Use TS to give your trade room to breathe in case of a strong breakout.

Frequently Asked Questions:

Are you confused about the differences between Stop Loss and Trailing Stop Forex strategies? Look no further! Here are some frequently asked questions to help you understand these two popular risk management techniques.

Q: What is a Stop Loss?

A: A Stop Loss is a risk management technique used to limit potential losses by automatically closing a trade when it reaches a certain price level. This price level is set by the trader and is usually below the current market price for long positions or above the current market price for short positions.

Q: What is a Trailing Stop?

A: A Trailing Stop is a type of Stop Loss that automatically adjusts to lock in profits as the trade moves in the trader’s favor. The Trailing Stop is set at a certain distance from the current market price and trails the price as it moves, hence the name.

Q: What are the key differences between Stop Loss and Trailing Stop?

A: The main difference between Stop Loss and Trailing Stop is that a Stop Loss is fixed at a specific price level, while a Trailing Stop is dynamic and adjusts to the market price. This means that a Trailing Stop can help lock in profits as the trade moves in the trader’s favor, whereas a Stop Loss remains at the same price level.

Q: When should I use a Stop Loss?

A: You should use a Stop Loss when you want to limit your potential losses to a specific amount. This is particularly useful for traders who are new to the market or who are trading with a small account size.

Q: When should I use a Trailing Stop?

A: You should use a Trailing Stop when you want to lock in profits as the trade moves in your favor. This is particularly useful for traders who are looking to maximize their profits and are willing to take on more risk.

Q: Can I use both Stop Loss and Trailing Stop together?

A: Yes, you can use both Stop Loss and Trailing Stop together. This is known as a “hybrid” approach, where you set a Stop Loss to limit your potential losses and a Trailing Stop to lock in profits. This approach can help you manage risk while also maximizing profits.

Q: Are there any risks associated with using Stop Loss and Trailing Stop?

A: Yes, there are risks associated with using Stop Loss and Trailing Stop. One of the main risks is that the market can gap beyond your Stop Loss or Trailing Stop, resulting in larger losses than expected. Additionally, Trailing Stops can be triggered by market volatility, resulting in premature closure of a trade.

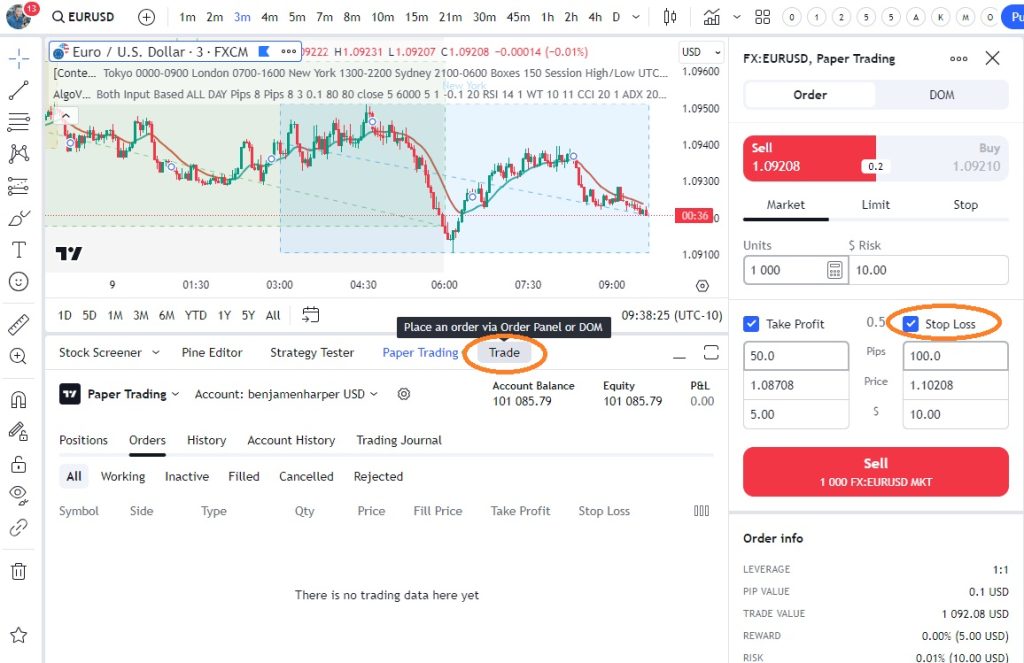

Q: How do I set a Stop Loss and Trailing Stop in my trading platform?

A: The process of setting a Stop Loss and Trailing Stop varies depending on your trading platform. You can usually find the option to set a Stop Loss and Trailing Stop in the “Orders” or “Trade” section of your platform. You can also consult your platform’s user guide or contact their customer support for assistance.

We hope this FAQ has helped you understand the differences between Stop Loss and Trailing Stop Forex strategies. Remember to always use risk management techniques responsibly and to consult with a financial advisor if you’re unsure about any aspect of trading.